Having a website that meets the needs of financial businesses is a strategic tool that builds credibility and trust with all stakeholders. This makes the development of standardized Financial Website Development an urgent necessity for organizations seeking to demonstrate transparency and responsibility to investors.

In this article, CIPHER, specialists in web design and development for businesses, will take you through the intricacies of developing websites for financial companies that are not only visually appealing but also support IR and ESG standards, which modern investors increasingly value.

Table of Contents

What is Financial Website Development?

Businesses today face increasingly intense competition. Having a suitable corporate website for companies in the financial sector has become an essential requirement. Financial Website Development is a crucial strategy that goes beyond creating ordinary websites—it involves developing digital systems that consider security, credibility, and compliance with various regulations. Let’s understand its meaning and importance more clearly.

Definition and Importance of Financial Websites

Financial Website Development refers to specialized website development for organizations in the financial sector, including banks, securities companies, insurance companies, or companies listed on the stock exchange.

These websites don’t just display organizational information; they also serve as important channels for communicating with shareholders, investors, customers, and the public. Having a trustworthy website acts as a mirror reflecting your organization’s stability and professionalism.

Differences from Regular Websites

Financial company websites differ significantly from regular websites because they must accommodate more complex and specialized needs:

- Higher security standards – Multiple layers of protection systems are required to safeguard financial and personal information

- Must comply with strict regulations – Whether requirements from the SEC, Stock Exchange, or other regulatory bodies

- Present complex information in an accessible manner – Financial data must be presented in accessible formats, including graphs, tables, and analysis

- Support multiple languages – Must communicate in at least Thai and English to accommodate foreign investors

Why Financial Websites Need Corporate Standards

Credibility for Shareholders and Investors

Modern investors often begin their investment decisions by researching information online. A standardized website serves as the first impression card for them.

When investors see a professionally designed website with complete, regularly updated information that’s easy to use, they’ll feel that the organization is serious about communication and attentive to details—key factors in building confidence.

Financial Data Security

Financial information is sensitive data requiring high-level protection. Financial website development must pay special attention to security, including:

- Data encryption with HTTPS standards to protect communication between users and the website

- Attack prevention systems for DDoS, SQL Injection, and other attack forms

- Vulnerability checks according to OWASP Top 10 standards regularly

- Efficient backup systems ready for quick recovery

Having a strong security system not only protects important information but also signals that your organization prioritizes protecting the interests of all stakeholders.

Compliance with Organizational Regulations (SET/SEC/ESG)

Additionally, ESG (Environment, Social, Governance) trends are receiving increasing attention. Websites that efficiently support ESG information presentation help organizations demonstrate social and environmental responsibility—a key factor modern investors use in their decision-making.

Complete Website Structure for IR and ESG

Investor Relations (IR) Page -- Financial Statements, Financial Highlights, Shareholder Structure

The IR section is the heart of Financial Website Development for listed companies, which must include:

- Financial Highlights – Presenting key figures in an easy-to-understand format with graphs and historical comparisons

- Historical financial statements – Both quarterly and annual, available for download in PDF format

- Management Discussion and Analysis (MD&A) – Providing insights into performance results

- Shareholder structure – Displaying major shareholders and ownership proportions

- Dividend policy – Explaining policy and dividend payment history

This section should be designed to allow investors to find information quickly and easily, with regular data updates.

ESG Section -- Environmental, Social, and Governance Reports

ESG is becoming an important factor in investment decisions. Having a comprehensive ESG section will help attract investors who prioritize sustainability, including:

- Environmental policies – Demonstrating commitment to reducing environmental impact

- Social responsibility activities – Presenting projects and activities for society

- Governance principles – Explaining good corporate governance structures

- Sustainability reports – Publishing annual sustainability reports

Presenting ESG information transparently not only attracts sustainability-conscious investors but also demonstrates the organization’s long-term vision.

Download Center for Important Documents

Having a central repository for important documents helps investors and interested parties access information conveniently, including:

- Annual reports – In both Thai and English

- Annual Registration Statement (Form 56-1) – As required by the SEC

- Shareholder meeting invitations – With supporting documents

- Minutes of shareholder meetings – Published after meetings conclude

- Presentations – For analysts and investors

Organizing documents in categories with an efficient search system helps users quickly access the information they need.

Shareholder and Investor Event Calendar System

An event calendar is an important tool that helps investors not miss important news and events, with features including:

- Financial statement announcement dates – Both quarterly and annually

- Shareholder meeting schedules – With venues and participation methods

- XD marking dates – And dividend payment dates

- Opportunity Day activities – And analyst meetings

- Connection with personal calendars – Allowing investors to add events to their personal calendars

A good calendar system should have advance notifications and automatic updates when changes occur, ensuring investors don’t miss important information.

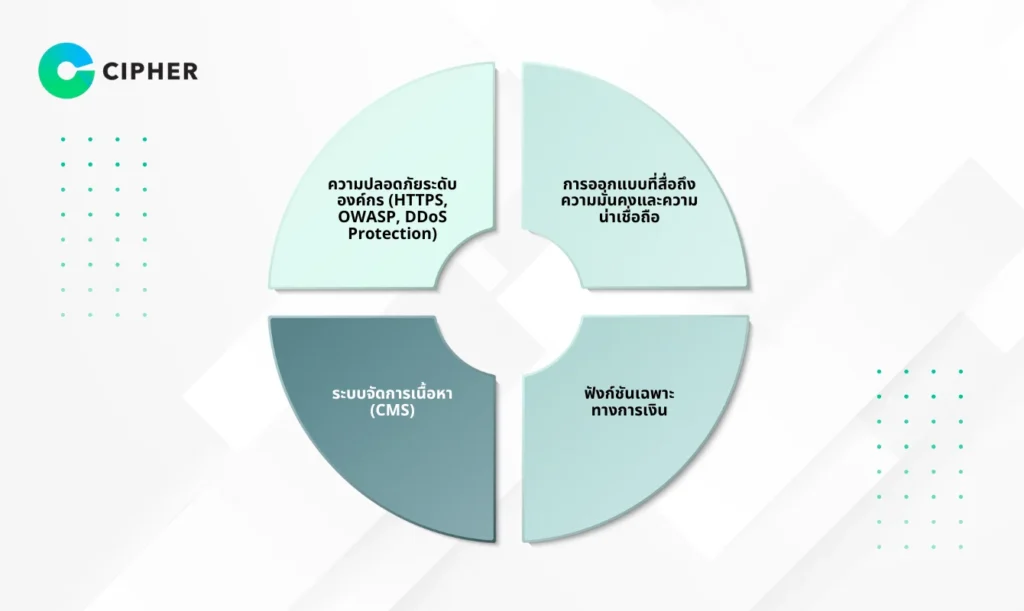

Key Components of Financial Website Development

Enterprise-Level Security (HTTPS, OWASP, DDoS Protection) for Financial Company Websites

Financial company website development must prioritize security above all else, as financial information is sensitive data requiring maximum protection. Security systems that should be included:

- EV (Extended Validation) SSL Certificate – Displaying a green bar with the organization’s name on browsers, increasing credibility

- HTTPS encryption throughout the website – Preventing data interception between users and the server

- Protection according to OWASP Top 10 standards – Covering the most common vulnerabilities

- DDoS protection system – Handling Distributed Denial of Service attacks

- Web Application Firewall (WAF) – Filtering harmful traffic

- Regular security checks – Both Vulnerability Assessment and Penetration Testing

A strong security system not only protects critical information but also builds user confidence that their information will be well protected.

Design Conveying Stability and Credibility

Financial sector company website design must reflect stability and credibility, which are core values of financial businesses. Key design elements for Financial Website Development include:

- Professional color tones – Blue, gray, or dark green that convey credibility and stability

- Organized and predictable layout – Helping users feel the organization has systematic processes

- Easy-to-read and formal fonts – Choosing fonts that align with the organization’s image

- Efficient use of white space – Not too crowded, making information easier to read

- High-quality photographs – Demonstrating professionalism and attention to detail

- Responsive Design – Supporting use on all devices—computers, tablets, and smartphones

Professional and sophisticated design creates a good first impression for website visitors and reflects the quality of management within the organization.

Financial-Specific Functions: Financial Reporting Systems, Multi-language, PDPA/Consent Management

Efficient Financial Website Development must have specialized functions that address the needs of financial businesses, including:

- Interactive financial reporting system – Allowing users to view data by time period and make comparisons

- Interactive graphs and charts – Making numerical data easier to understand

- Multi-language system – At minimum, Thai and English

- PDPA consent management system – Allowing users to manage their personal data collection

- Automatic notification system – For important news and events

- Efficient search system – Helping users quickly access desired information

- Messaging system and investor relations contact – For direct communication with the organization

These functions not only help the website function well but also help organizations comply with legal requirements and create good user experiences.

Content Management System (CMS) That Teams Can Update Themselves, with User Manuals

An easy-to-use Content Management System (CMS) is a key component of efficient Financial Website Development because it allows teams to update information quickly themselves without relying on technical teams. Features that should be included:

- User-friendly management interface – Designed for users without technical knowledge

- Content approval system – To verify accuracy before publishing

- User permission settings – Allowing specification of who can edit which parts of the website

- File and image management system – Assisting with document file uploads and management

- News and announcement management system – For publishing organizational news

- Publication scheduling – Setting advanced times for content publication

- Detailed user manuals – Both document and video tutorials

A good CMS helps organizations update information in a timely manner, which is very important for financial sector companies that must publish information within legally mandated timeframes.

SEO Optimization for Financial Websites

SEO-Friendly URL Structure and Breadcrumbs

Clear URL structures and good breadcrumbs not only help with SEO but also help users understand where they are on the website more easily. Practices that should be followed include:

- Short and understandable URLs – Such as /investor-relations/financial-reports/q2-2025 instead of /page.php?id=123

- Using keywords in URLs – Helping both users and search tools understand the content of that page

- Clear breadcrumbs – Showing the navigation path from the main page to the current page

- Hierarchical website structure – Systematically categorizing content

Using Canonical URLs – Preventing duplicate content issues

Good URL structure and clear breadcrumbs help users understand the website structure more easily and help search tools categorize content correctly.

Schema Markup for Financial Statements, News, and Key Organizational Personnel

Schema Markup is special code that helps search tools better understand website content. For financial company websites, using appropriate Schema Markup will help important information appear prominently in search results.

- Schema Markup for organizations – Displaying basic information, logos, and contact channels

- Schema Markup for individuals – For executives and key team members

- Schema Markup for news – Helping organizational news appear in the news section of search results

- Schema Markup for events – For shareholder meetings and important events

- Schema Markup for financial information – For financial products and services

Proper use of Schema Markup helps important organizational information appear prominently in search results, such as Rich Snippets showing star ratings, stock prices, or contact information, which significantly increases click-through rates.

On-Page SEO Techniques and Website Speed Optimization

On-Page SEO optimization and website speed are important factors affecting search rankings. Techniques that should be used in Financial Website Development include:

- Using appropriate Title Tags and Meta Descriptions – Including keywords and attention-grabbing information

- Structuring headings (H1, H2, H3) – Helping search tools understand content priority hierarchy

- Image optimization – Reducing file sizes and using Alt Text that describes images well

- Using Internal Linking – Systematically linking between different pages within the website

- Using Lazy Loading – Loading only the content users see first

- Using Browser Caching – Storing some files on users’ devices for faster loading

- Using Content Delivery Network (CDN) – Distributing file loading to servers closest to users

Website speed is an important factor for both search rankings and user experience. Fast-loading websites help reduce bounce rates and increase engagement rates.

Content Strategy Based on E-E-A-T Principles to Build Confidence

Quality content is the heart of modern SEO, especially for financial sector websites categorized as YMYL (Your Money, Your Life), which Google gives special importance to credibility. Creating content according to E-E-A-T principles (Experience, Expertise, Authoritativeness, Trustworthiness) helps build confidence for both users and search tools.

- Demonstrate experience – Present case studies and organizational success examples

- Show expertise – Publish articles and analyses written by experts in the organization

- Demonstrate authority in the industry – Reference credible and recognized sources

- Build trust – Present accurate, up-to-date, and complete information

Having a good content strategy helps websites not only rank in searches but also build confidence and trust with all stakeholders.

Website Performance Analysis and Monitoring

Analytics Installation and User Analysis Dashboard for Financial Company Websites

Installing analytics systems is an important part of financial company website development because it helps understand user behavior and website performance. Tools and features that should be included:

- Google Analytics 4 – Analyzing user behavior, traffic sources, and content performance

- Google Search Console – Monitoring search ranking status and issues found

- Heat Map Tools – Analyzing detailed usage behavior such as clicking and scrolling

- Real-time summary dashboards – Displaying important information in an easy-to-understand format

- Monthly reports – Summarizing performance and interesting trends

Installing comprehensive analytics systems helps organizations deeply understand user behavior and use that information to improve websites to better meet user needs.

Conversion and Engagement Reports

Measuring website success isn’t just about visitor numbers but also includes Conversions and Engagement, which are indicators of whether the website can achieve business objectives.

- Setting Conversion Goals – Such as annual report downloads, newsletter registrations, or contact form submissions

- Measuring User Engagement – Such as time spent on the website, pages viewed per session, and bounce rates

- Usage path analysis – To understand whether users can conveniently access the information they want

- Content performance measurement – To understand which content receives the most attention

- Analysis by user groups – To understand the different needs of each group

Detailed Conversion and Engagement analysis helps organizations concretely measure website success and leads to targeted improvements.

Continuous Website Improvement

Financial Website Development isn’t a project with an endpoint but a continuous process to maintain efficiency and meet changing needs.

- A/B Testing – Comparing the performance of different designs or content

- Improvements based on analytics – Using data from analytics systems for improvements

- Technology updates – Tracking and implementing new technologies to increase efficiency

- Listening to user feedback – Surveying satisfaction and receiving suggestions

- Competitor monitoring – Analyzing competitor strategies and adapting them appropriately

Continuous website improvement not only maintains efficiency but also demonstrates the organization’s commitment to development and adaptation to changing environments.

Challenges of Financial Website Development and Solutions

Website development for businesses in the financial sector has specific challenges requiring appropriate solutions so websites can meet the needs of both organizations and users.

Presenting Complex Information Readably for Financial Company Websites

Financial information is often complex and difficult to understand. Good financial company website development must present this information in an accessible format.

- Using graphs and charts – Converting numbers into easily understood visuals

- Dividing information into sections – Presenting one section at a time to prevent users from feeling overwhelmed

- Using easy-to-understand language – Avoiding difficult technical terms or providing explanations

- Using Infographics – Summarizing important information in interesting formats

- Using explanatory videos – Presenting complex information in easily understood video formats

Presenting complex information in an accessible way not only helps users better access information but also demonstrates the organization’s ability to communicate effectively

Complying with Strict Regulations

Financial businesses must comply with strict regulations from various regulatory agencies. Website development must consider these regulations and strictly comply with them.

- Disclosure according to SEC requirements – Both format and timing of disclosure

- Compliance with PDPA – Proper personal data management

- Displaying disclaimers – To prevent misunderstandings and legal liability

- Storing access logs – As required by law

- Updating privacy policies – To comply with changing laws

Strict compliance with regulations not only helps organizations avoid legal risks but also builds user confidence that the organization conducts business correctly and responsibly.

Building Confidence in the Digital Age

Confidence is the most important thing for financial businesses, especially in the digital age where online transactions carry increased risks. Building confidence through websites is therefore an important challenge.

- Displaying certificates and awards – To confirm organizational credibility

- Showing customer testimonials – Building confidence through others’ experiences

- Providing transparent information – Both positive and negative

- Responding quickly – To questions and complaints

- Showing team identity – Letting users feel they’re contacting real people, not faceless organizations

Building confidence through websites is a continuous and consistent process to make users feel trust in using services and investing with the organization.

Financial Website Development Process with Professional Teams

Business Analysis and Website Structure Planning

The first step in Financial Website Development is thoroughly understanding the business and organizational needs to establish an appropriate website structure.

- Meetings to understand requirements – Listening to expectations and organizational goals

- Target audience analysis – Understanding user behavior and needs

- Competitor study – Analyzing strengths and weaknesses of competitor websites

- Website structure planning – Designing comprehensive and systematic structures

- Defining Sitemap and User Flow – Planning navigation and user experience

Careful analysis and structure planning help website development proceed with direction and truly meet organizational needs.

UX/UI Design and Development with Latest Technology

After structure planning, the next step is designing user experience (UX) and user interface (UI) that are beautiful and easy to use, developed with modern technology.

- Wireframe design – Drafting page structures to check component placement

- Mockup design – Creating complete page simulations

- Responsive Design – Supporting use on all devices

- Development with latest technology – Such as HTML5, CSS3, JavaScript, and modern frameworks

- Back-end system development – Creating easy-to-use content management systems

Quality design and development help websites not only look beautiful but also function well and support future growth.

Quality and Security System Testing

Before officially launching the website, thorough testing is necessary to ensure everything works correctly and securely.

- Usability Testing – Checking whether users can easily use the website

- Compatibility Testing – Checking display on various browsers and devices

- Performance Testing – Checking speed and responsiveness

- Security Testing – Finding vulnerabilities and security weaknesses

- Load Testing – Checking performance with many users

Detailed testing ensures the website is ready for actual use and can efficiently meet user needs.

Website Delivery with User Manuals and Ongoing Support Services

The final step is delivering the website with user manuals and ongoing support services so organizations can use the website to its full potential.

- Website installation on servers – With appropriate settings

- Creating user manuals – Both document and video tutorials

- Team training – Enabling teams to manage content themselves

- After-sales service – Providing consultation and solving potential problems

- Maintenance and upkeep – Regular system updates and security checks

Complete delivery and ongoing support services help organizations use the website smoothly and efficiently in the long term.

Why Choose CIPHER for Financial Website Development

Choosing the right partner for corporate website development is an important factor affecting project success. CIPHER has strengths that make it a suitable choice for Financial Website Development.

Experience with Leading Financial Organizations for Financial Company Websites

CIPHER has extensive experience developing websites for many leading financial companies, giving us a deep understanding of the specific needs and challenges of businesses in the financial sector.

- Work with leading organizations – We’ve worked with banks, securities companies, and leading insurance companies

- Understanding regulations – We know and understand SEC and Stock Exchange requirements

- Proven approaches – We have development approaches proven to be effective

- Successful case studies – We have many success examples that can be referenced

- Understanding investor needs – We know what investors want from listed company websites

Our accumulated experience allows CIPHER to anticipate challenges and prepare solutions in advance, helping website development proceed smoothly and efficiently.

Expert Team and HubSpot Partner

Team quality is a key factor in project success. CIPHER has a highly skilled and experienced team.

- Professional team – Comprising experts in each area—design, development, and SEO

- Partnership with HubSpot – An official partner with HubSpot, a world-leading marketing platform

- Continuous skill development – The team receives regular training and skill development

- Support team ready to assist – Ready to answer questions and solve problems quickly

- Systematic work process – Clear and efficient work steps

Quality teams and strong partnerships enable CIPHER to deliver high-quality work that precisely meets customer needs.

High Standards of Security and Credibility

Security is CIPHER’s top priority, especially for financial sector websites requiring high security standards:

- Development according to international security standards – Such as OWASP Top 10 and ISO 27001

- Rigorous security testing – Both Vulnerability Assessment and Penetration Testing

- Regular security monitoring and updates – To address new threats

- Certifications and standards – Confirming quality and credibility

- Transparency in operations – Clearly explaining steps and processes

High security standards and credibility allow customers to trust CIPHER in developing websites that are not only beautiful and easy to use but also highly secure and credible.

Conclusion

Standardized Financial Website Development supporting IR/ESG is essential for financial businesses seeking to build credibility and trust with all stakeholders. Investing in quality website development not only helps improve organizational image but also increases communication and service efficiency.

CIPHER is a suitable partner for corporate website development with extensive experience, expert teams, and high security standards. We are ready to help your organization enter the digital age with websites that meet both business needs and user expectations. Contact us today to begin corporate website development that will elevate your businessto the next level.